Join Our Team as a Loan Officer

Are you an ambitious and skilled loan officer looking to take your career to the next level? Do you thrive in a dynamic, client-focused environment? If so, we invite you to consider an exciting opportunity with our company, a leader in the mortgage industry that uniquely operates as both a mortgage broker and a mortgage banker.

- Competitive compensation with strong earning potential

- Operational and marketing support to help you close more

- lient-focused culture with modern tools

"*" indicates required fields

Be Part of a Growing & Winning Team

Work alongside driven professionals in a supportive, results-focused environment. We combine strong leadership, smart systems, and a client-first mindset to help you succeed and grow.

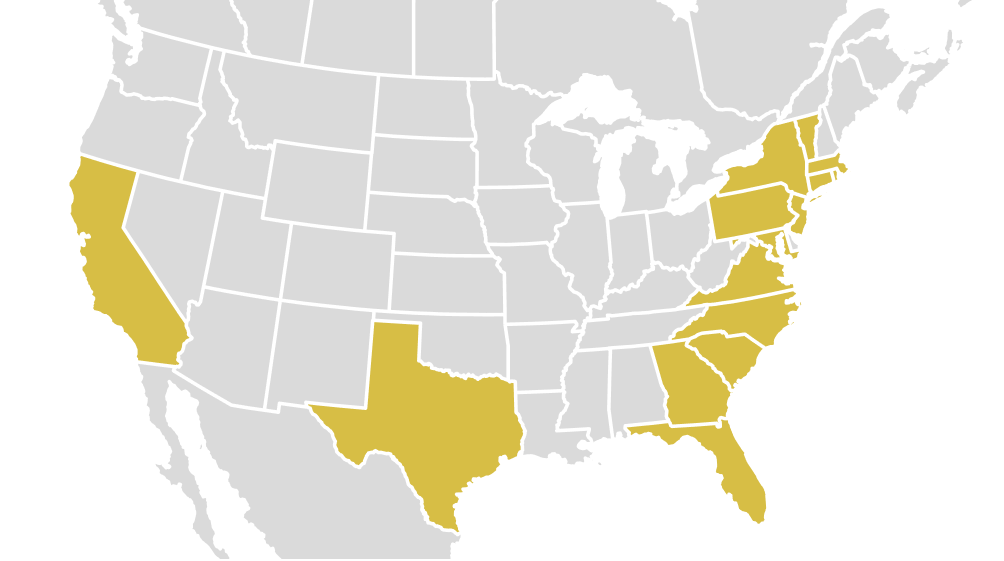

Our Licensed States

We’re proud to serve homeowners and businesses across the country. Explore our licensed states and see how we can help you achieve your goals wherever you are.

CA CT FL GA MA MD NJ NY NC PA RI SC TX VA VT

Verify our licenses at www.nmlsconsumeraccess.org

Why Work With Us?

Discover what sets our team apart and why top-performing loan officers choose to build their careers with us.

1

Dual Capabilities

As a hybrid mortgage broker and banker, you gain the flexibility to serve clients with the right solution for every scenario. Access a wide range of lender options while also funding loans directly—giving you more control and competitive advantage.

2

Comprehensive Training

We invest in your success with ongoing training, hands-on support, and expert guidance. From industry updates to deal-specific assistance, our experienced team helps you navigate complex transactions and close confidently in a fast-moving market.

3

High-Earning Potential

Our compensation structure is designed to reward performance and growth. With competitive commission opportunities and incentive-based earnings, your hard work is recognized and directly tied to your success and long-term earning potential.

4

Advanced Technology

Our modern technology platform streamlines the loan process from application to close. With fewer administrative hurdles, you can focus more time on relationships, referrals, and closing deals—while we handle the operational complexity behind the scenes.

Your Responsibilities

As a loan officer with our team, you will:

01

Develop and Maintain Relationships

Cultivate strong relationships with real estate agents, builders, and other referral sources to generate leads and build a robust pipeline of business.

02

Assess Client Needs

Conduct thorough interviews with clients to understand their financial situation and mortgage needs, providing tailored solutions that best meet their goals.

03

Guide Clients Through the Process

Assist clients throughout the mortgage application process, ensuring they understand their options and are kept informed every step of the way.

04

Stay Informed

Keep abreast of the latest industry trends, market conditions, and regulatory changes to provide accurate and timely advice to clients.

Ready to Elevate Your Career?

If you’re looking for a high-performance, forward-thinking mortgage company that values transparency, innovation, and your success, Warshaw Capital LLC is the place for you.